PJT PARTNERS INC : PJT Stock Price US69343T1079

PJT PARTNERS INC : PJT Stock Price US69343T1079

Contents:

The technique has proven to be very useful for finding positive surprises. In fact, when combining a Zacks Rank #3 or better and a positive Earnings ESP, stocks produced a positive surprise 70% of the time, while they also saw 28.3% annual returns on average, according to our 10 year backtest. In 2015, PJT Partners, Inc. was created from a merger of the advisory arm of The Blackstone Group and PJT Capital LP, a strategic advisory firm founded by Paul Jefferey Taubman in 2013.

Access unmatched financial data, news and content in a highly-customised workflow experience on desktop, web and mobile. Build the strongest argument relying on authoritative content, attorney-editor expertise, and industry defining technology. For US and Canadian Stocks, the Overview page includes key statistics on the stock’s fundamentals, with a link to see more.

About MarketBeat

“Many Blackstone M&A bankers expected to depart ahead of spin off to Taubman”. In 2015, before the firm began operations, Taubman hired a number of senior European bankers to lead PJT Partners’ European operation. Soon after the firm was founded, former NBA Commissioner David J. Stern joined the firm as a senior adviser. PJT Partners doesn’t possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report.

Conversely, NIM is disappointing, especially compared to the leading comps such as Evercore . Presented above is Analysts’ consensus view on PJT’s FY23. Given the cyclical nature of IB, the forecasts are not to be relied on, however, they can provide some useful directional information given analysts speak to Management.

Nextracker announces IPO pricing – pv magazine USA – pv magazine USA

Nextracker announces IPO pricing – pv magazine USA.

Posted: Thu, 09 Feb 2023 08:00:00 GMT [source]

View the PJT premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the PJT Partners Inc real time stock price chart below. You can find more details by visiting the additional pages to view historical data, charts, latest news, analysis or visit the forum to view opinions on the PJT quote. The Company offers strategic advisory, restructuring and reorganization, fund placement and funds advisory services to corporations, financial sponsors, institutional investors and governments. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

Live educational sessions using site features to explore today’s markets. Our view is that the valuation is likely slightly rich, only because investors can get a “better” deal on the cheaper end with Raymond James or Stifel , or similar growth but better profitability with Houlihan or Moelis. PJT is valued at the top end of the peer group, with markets likely reflecting a premium from the average on its superior growth. Profitability delta between Houlihan / Moelis and PJT is to some extent offset by commercial superiority and better growth. PJT is performing relatively well, without standing out on a profitability basis. The positives are that the company has seen margin expansion in the last period, whereas the majority of its peers have seen a decline due to softer business.

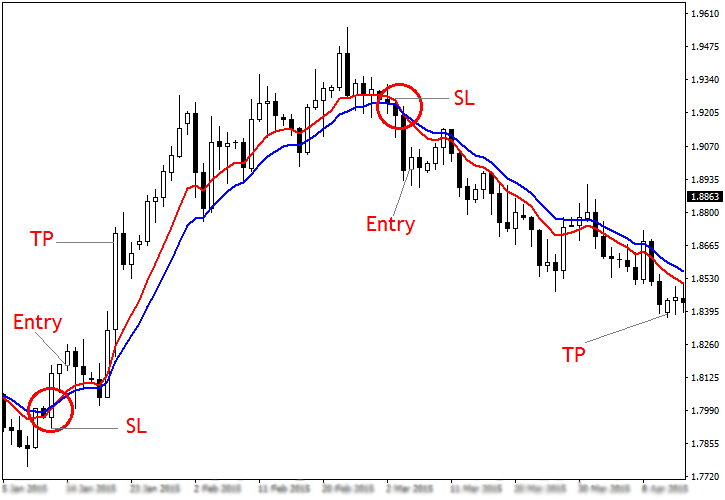

With PJT’s services primarily in the advisory space, it is worth us diving deeper into the current market conditions. As the following graph illustrates, we have seen a noticeable decline in activity during 2022, with this extending further into FY23, making it difficult to assess if we have seen the “bottom” yet. The business looks commercially strong, developing a range of advisory services which are complimentary in nature. Investing.com – PJT Partners Inc reported on Tuesday third quarter erl ||earnings that missed analysts’ forecasts and revenue that topped expectations.

Key Data

It offers advisory services to clients on various transactions, including mergers and acquisitions (M&A), spin-offs, activism defense, contested M&A, joint ventures, minority investments, and divestitures. Additionally, it provides private fund advisory and fundraising services for a range of investment strategies; and advisory services to GPs and LPs on liquidity and other structured solutions in the secondary market. The company was formerly known as Blackstone Advisory Inc. and changed its name to PJT Partners Inc. in March 2015. PJT Partners Inc. was incorporated in 2014 and is headquartered in New York, New York. PJT Partners Inc is an advisory-focused investment bank that offers a portfolio of advisory services designed to help its clients achieve their strategic objectives.

Mobileye Announces Pricing of Initial Public Offering – Business Wire

Mobileye Announces Pricing of Initial Public Offering.

Posted: Tue, 25 Oct 2022 07:00:00 GMT [source]

The firm is routinely cited as one of the best paying firm’s in the industry where average pay per head is ~$750,000 and has the highest pay for first year analysts. This score is calculated as an average of sentiment of articles about the company over the last seven days and ranges from 2 to -2 . This is a higher news sentiment than the 0.58 average news sentiment score of Finance companies. According to analysts’ consensus price target of $86.33, PJT Partners has a forecasted upside of 25.5% from its current price of $68.77. Represents the company’s profit divided by the outstanding shares of its common stock.

PJT Partners Non-GAAP EPS of $1.08 misses by $0.15, revenue of $279.95M misses by $17.34M

Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters. The Barchart Technical Opinion widget shows you today’s overally Barchart Opinion with general information on how to interpret the short and longer term signals. Unique to Barchart.com, Opinions analyzes a stock or commodity using 13 popular analytics in short-, medium- and long-term periods. Results are interpreted as buy, sell or hold signals, each with numeric ratings and summarized with an overall percentage buy or sell rating. After each calculation the program assigns a Buy, Sell, or Hold value with the study, depending on where the price lies in reference to the common interpretation of the study.

- This story was reviewed by MarketBeat’s editorial team prior to publication.

- News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services.

- “Many Blackstone M&A bankers expected to depart ahead of spin off to Taubman”.

- Barchart is committed to ensuring digital accessibility for individuals with disabilities.

Sachem Capital Corp. delivered earnings and revenue surprises of 18.18% and 14.45%, respectively, for the quarter ended December 2022. Do the numbers hold clues to what lies ahead for the stock? MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on…

PJT Partners Insider Activity

The firm has a 50 day moving average of $74.40 and a 200-day moving average of $75.61. PJT Partners Inc. has a 12 month low of $62.52 and a 12 month high of $83.17. The firm has a market capitalization of $1.67 billion, a P/E ratio of 19.69 and a beta of 0.78. Interestingly, PJT is expected to grow, although marginally. Having looked at quite a few of the listed boutique investment banks, this is a rare sight.

Breakingviews – Credit Suisse puts “first” back into First Boston – Reuters.com

Breakingviews – Credit Suisse puts “first” back into First Boston.

Posted: Thu, 03 Nov 2022 07:00:00 GMT [source]

PJT has a forward dividend yield of 1.45%.SeePJT’s full dividends and stock split historyon the Dividend tab. Highlights important summary options statistics to provide a forward looking indication of investors’ sentiment. The Barchart Technical Opinion rating is a 72% Sell with a Strongest short term outlook on maintaining the current direction.

A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations.

Margins are unattractive, with the market pricing growth mainly. Other listed IBs look more attractive currently based on valuation. As an investor, you want to buy stocks with the highest probability of success. That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style. By creating a free account, you agree to our terms of service. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

About PJT Partners (NYSE:PJT) Stock

https://1investing.in/ Industrial Average, S&P 500, Nasdaq, and Morningstar Index quotes are real-time. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

Those expected to grow have large loan books, allowing them to benefit from higher interest rates. The factor PJT is expected to grow shows the quality of its advisory practice, as its likely offsetting business from restructuring will support resilient equity work. The improvement in margins has been driven by improving revenue, which is driven by the factors discussed above, as well as a dilution of compensation as the company has continued to recruit. Unlike many of its peers, revenue has grown at a greater rate than compensation on an individual basis, ensuring that motivations are aligned with shareholders. Further, c.40% of the business is owned by shareholders, ensuring alignment of interests. Our view is that a compensation ratio of NI margins would be higher if not for the c.45% of PAT deducted due to non-controlling interests, with amounts split between partnership units and Class A shares.

Market Cap is calculated by multiplying the number of shares outstanding by the stock’s price. To calculate, start with total shares outstanding and subtract the number of restricted shares. Restricted stock typically is that issued to company insiders with limits on when it may be traded.Dividend YieldA company’s dividend expressed as a percentage of its current stock price. PJT Partners, Inc. is a holding company, which engages in the provision of advisory-investment solutions. It specializes in strategic advisory, shareholder engagement, restructuring and special situations and private fund advisory and placement services to corporations, financial sponsors, institutional investors, and governments. The company was founded on November 5, 2014 and is headquartered in New York, NY.

PJT is positioned perfectly to steal more market share and continue to grow rapidly. PJT is trading at the top end of the IB valuations, making it difficult to rate it a buy today. NIM is unattractive relative to other IBs, despite the better growth. Revenue has grown well, driven by strong MD recruitment and a solid client base.

when currencies fail a primer on the dollar crisis flag for targeted data from your country of choice. Provides a general description of the business conducted by this company. Barchart is committed to ensuring digital accessibility for individuals with disabilities. We are continuously working to improve our web experience, and encourage users to Contact Us for feedback and accommodation requests. Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

- Money Flow Uptick/Downtick RatioMoney flow measures the relative buying and selling pressure on a stock, based on the value of trades made on an “uptick” in price and the value of trades made on a “downtick” in price.

- Real-time quotes, advanced visualizations, backtesting, and much more.

- The company generates its revenue from advisory fees, placement fees, and others.

- Maintaining independence and editorial freedom is essential to our mission of empowering investor success.

- Specifically, they have bought $0.00 in company stock and sold $2,396,400.00 in company stock.

This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.27% per year. These returns cover a period from January 1, 1988 through April 3, 2023. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month.

Finally, Keefe, Bruyette & Woods increased their target price on shares of PJT Partners from $80.00 to $85.00 and gave the stock an “outperform” rating in a research report on Tuesday, January 3rd. There are many reasons why PJT has been able to grow as it has, one of those being its leading recruitment of senior personnel. In the advisory/consulting business, the biggest driver of growth is personnel. Recruiting a highly regarded individual is akin to a successful takeover of a competitor. PJT is in a position to lure top talent to the business because of its roots. As the following graphs illustrate, PJT has seen rapid growth in personnel, aligning with Client growth.

MarketRank is calculated as an average of available category scores, with extra weight given to analysis and valuation. To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research. Verify your identity, personalize the content you receive, or create and administer your account. LP2.96Vanguard Total Stock Market Index Fund2.81BlackRock Institutional Trust Co. NA2.50Vanguard Small Cap Index Fund2.39abrdn, Inc.2.29State Street Corp.2.11Balyasny Asset Management LP2.01Shareholder percentage totals can add to more than 100% because some holders are included in the free float.